In 2016, the SEC introduced Regulation Crowdfunding to the investing and startup world, which made crowdfunding investments significantly easier for emerging startups in the US. Regulation Crowdfunding can democratize the investment process, which can be an appealing option for startups looking to acquire funding from a wider pool of investors. However, Regulation Crowdfunding can also allow inexperienced investors with less risk-resilience to jump into high-stakes opportunities, which can spell trouble down the line for both startups and investors. We go into detail here on what crowdfunding is and what startups need to know ahead of time.

not all (crowd)funding is the same

There are three types of crowdfunding: rewards, debt, and equity. Regulation Crowdfunding refers specifically and only to equity—the distinctions are crucial to understand.

rewards crowdfunding is what you see on Kickstarter or Indiegogo: in exchange for a small amount of support, people are given rewards (pre-orders, services, recognition/swag). Equity crowdfunding is not Kickstarter: if you are interested in selling equity in your startup or borrowing money from the customers of your small business, you must realize you are selling securities in your business, which is a highly-regulated activity.

rewards crowdfunding is what you see on Kickstarter or Indiegogo: in exchange for a small amount of support, people are given rewards (pre-orders, services, recognition/swag). Equity crowdfunding is not Kickstarter: if you are interested in selling equity in your startup or borrowing money from the customers of your small business, you must realize you are selling securities in your business, which is a highly-regulated activity.

debt crowdfunding encompasses several different types of lending. These include mini-bonds, peer-to-peer lending and invoice financing. Some of VentureWell’s Powering Agriculture Xcelerator Innovator teams have benefited from Kiva, a debt crowdfunding platform that provides users with crowdsourced loans from around the world.

debt crowdfunding encompasses several different types of lending. These include mini-bonds, peer-to-peer lending and invoice financing. Some of VentureWell’s Powering Agriculture Xcelerator Innovator teams have benefited from Kiva, a debt crowdfunding platform that provides users with crowdsourced loans from around the world.

equity crowdfunding is a mechanism that enables investors to fund startup companies and small businesses in return for equity. When we talk about Regulation Crowdfunding, we’re talking about capital exchanged for equity. Investors give money to a business and receive ownership of a small piece of that business.

equity crowdfunding is a mechanism that enables investors to fund startup companies and small businesses in return for equity. When we talk about Regulation Crowdfunding, we’re talking about capital exchanged for equity. Investors give money to a business and receive ownership of a small piece of that business.

Equity crowdfunding is a new—and highly regulated—ball game. Unlike a Kickstarter campaign or taking out a small loan, securing equity crowdfunding requires much more work than putting together a short application or creating an amazing video, great rewards, and photos of your community.

the regulations

In order to fully address the impacts of the new rules, we need to understand all of the rules related to crowdfunding that have rolled out through President Obama’s Jumpstart Our Business Startups Act (JOBS Act).

Every time a startup raises capital in exchange for shares of its company, the transaction must be registered with the Securities and Exchange Commission (SEC), unless an exemption applies. The JOBS Act added two new, critical exemptions for startups to broaden their fundraising options: Rule 506(c) of Regulation D and Regulation Crowdfunding.

These exemptions are a big deal, because registering securities with the SEC without an exemption involves hundreds of hours of paperwork (the required Form S-1 has an estimated time burden of 972.32 hours) followed by required public financial reporting annually and quarterly. Through the new exemptions, the JOBS Act greatly reduces the amount of paperwork required and accommodates for “the power of the Internet” to create a wider pool of investors. Startups need to make sure they understand the exemptions in order to abide by them appropriately.

Title II

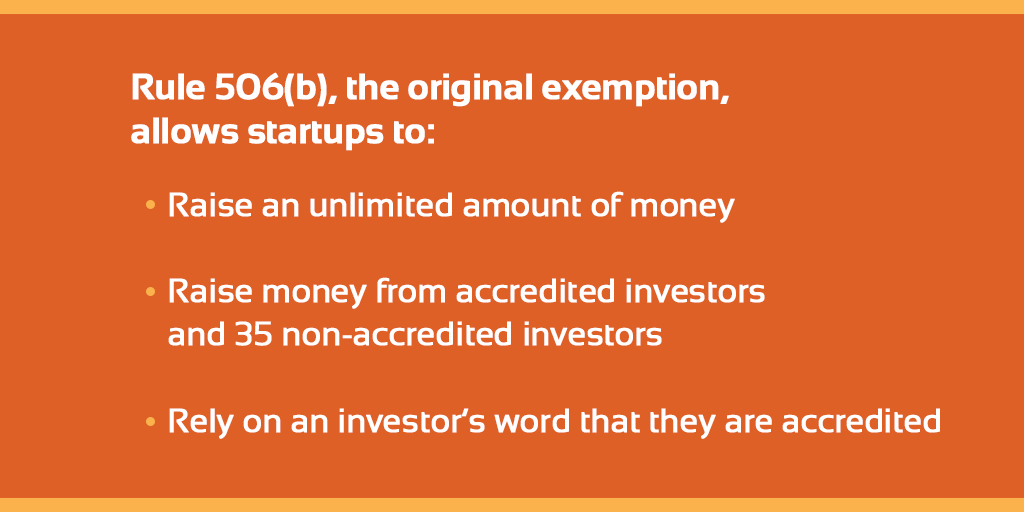

When the JOBS Act was introduced, it was the first time startups were allowed to publicly fundraise. This change was made through Title II of the JOBS Act in September 2013, which lifted the longstanding ban on general solicitation by splitting the previously existing Rule 506 of Regulation D into 506(b) and 506(c).

The key benefit here is a reduction in paperwork: since you can rely on an investor’s word that they’re accredited, the average time it takes to fill out the form (Form D) is four hours. This is the old, reliable exemption that most seed-stage startups have used for decades.

One caveat is that is that if you want to use 506(b) you cannot speak publicly about selling stock in your company. You can’t present the offering in any seminar or meeting where attendees have been invited by any general solicitation or general advertising. If you do so without realizing it, you could end up needing to use 506(c).

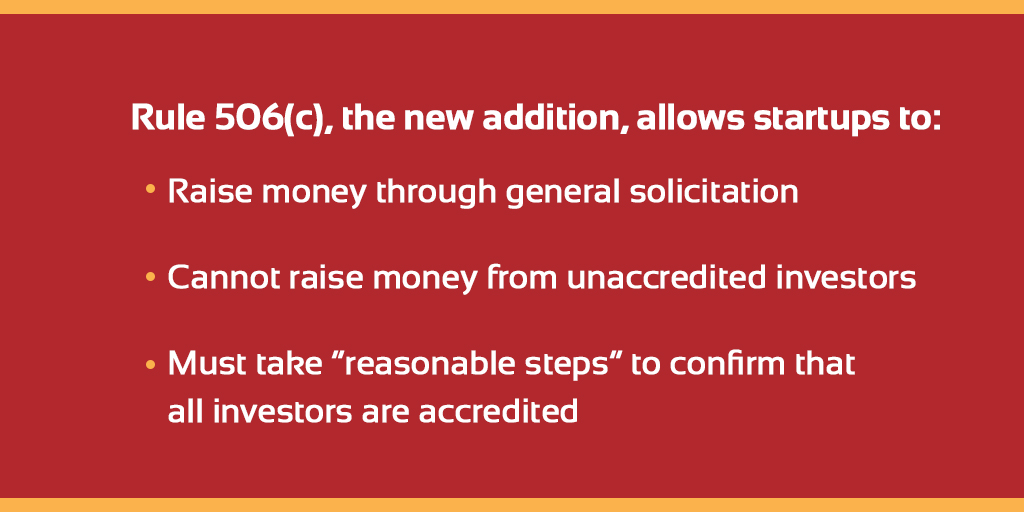

If a startup wants to advertise the sale of its shares publicly (websites, public events, billboards, TV, etc.) it can use rule 506(c). While 506(c) allows startups to raise money publicly, the investors have to be accredited (i.e., they have to meet certain wealth or income requirements) and the burden is on the entrepreneur to verify that they’re accredited. This is important to do correctly, since making a mistake can result in the cancellation of your round. We have seen this happen before: a team raised money using 506(c), but did not verify that investors were accredited. It turned out that the investors were not accredited and the startup had to return the funds. The consequences can be worse: failure to get verification could also freeze the company out of doing any offerings for a full year.

Title III: Regulation Crowdfunding

Regulation Crowdfunding, which went into effect on May 16, 2016, opens up the playing field to allow non-accredited investors to participate in publicly advertised financings. Here’s how this one works:

- Non-accredited investors can now participate in equity investing transactions in a limited way. People can invest:

- The greater of $2,000 or 5 percent of their annual income or net worth, if annual income or net worth of the investor is less than $100,000;

- 10 percent of their annual income or net worth (not to exceed an amount sold of $100,000), if annual income or net worth of the investor is $100,000 or more

- A startup can raise up to $1M in 12 months via crowdfunding.

- Varying levels of public financial disclosure are required depending on how much money is raised, including the price per share, audited financial statements, information about majority shareholders, along with public annual reports post-investment.

Regulation Crowdfunding has had a widespread effect on investors and startups alike. While it has opened access for anyone to invest in startups they believe in, there’s also a higher risk that inexperienced investors will lose their money in a bad investment. Startups and other small businesses can now raise money from nearly anyone, but there are rules and responsibilities associated with the process that entrepreneurs need to be aware of before diving in. All in all, equity crowdfunding can be a fantastic way to raise the resources necessary for startup growth. As you move forward in navigating the thorny regulations, be sure to work with an experienced lawyer who can guide you through the process.

Note: none of the content in this article is intended as legal advice.

Early-stage student entrepreneurs learn about funding during our exclusive E-Team grant program. Learn more about the program here.