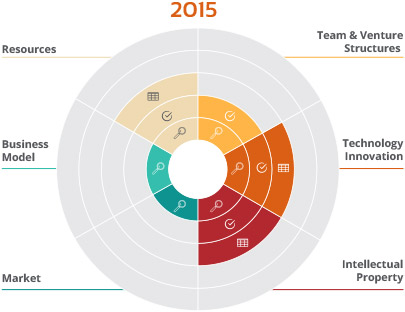

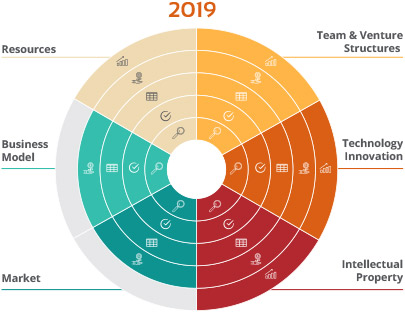

Using practice-based evidence, VentureWell developed the Venture Development Framework (VDF) to describe the development of early-stage science- and technology-based ventures. This framework can inform the development, implementation, and evaluation of programs supporting entrepreneurs. For example, it can help practitioners define program scope, develop program content, or identify program gaps and partners. For researchers and evaluators, it can inform program evaluation by articulating what milestones ventures can achieve after completing different programs.

The foundational framework is presented in the technical brief Developing and Evaluating Programs for Early-Stage Entrepreneurs: Describing Science and Technology-Based Venture Development.

Scroll through the document below for an overview of the VDF.

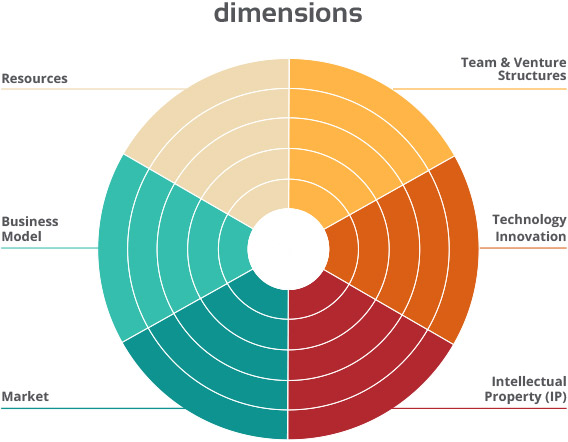

Dimensions of Venture Development

The Venture Development Framework describes the development of science- and technology-based ventures at the very earliest stages of commercialization. It is focused primarily on a trajectory for for-profit ventures that will likely seek equity investments. It describes venture development along six dimensions:

Team & Venture Structures

The people involved in and the structure of the venture.

Technology Innovation

The product/service, including the ability to manufacture it.

Intellectual Property (IP)

The strategy and structures needed to secure venture-owned IP and to license university-owned IP (if relevant).

Market:

The intended stakeholders/customers.

Business Model

How the team will make money, self-sustain, and/or disseminate the innovation.

Resources

The financing and relationships/institutional support needed to advance the venture.

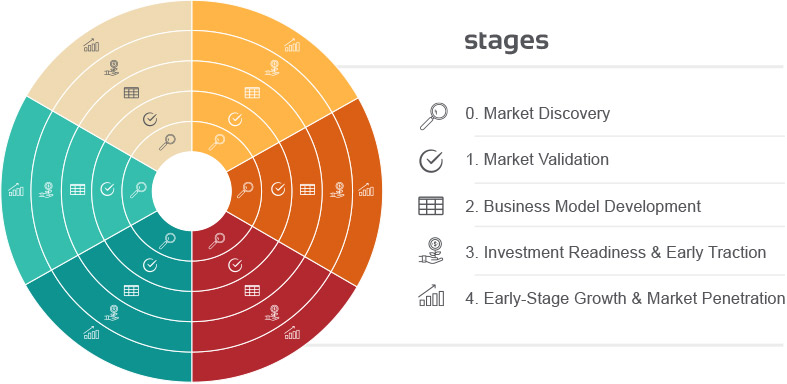

Venture Development Stages

For each of the dimensions, we have identified stages: the observable changes we expect to see as a venture develops over time. The five venture development stages focus on teaching the concepts to promote progress.

Explore the interactive framework below to learn more about the five development stages and their respective steps: